UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

the Securities Exchange Act of 1934 (Amendment No. )

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Welcome to the Duke Energy

| | ![[MISSING IMAGE: ph_lynngoodcovernew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_lynngoodcovernew-4c.jpg) | | | March 21, 2022 Dear Fellow Shareholders:

I am pleased to invite you to Duke Energy’s Annual Meeting to be held on Thursday, May 5, 2022, at 1:00 p.m. Eastern time. We look forward to updating you at the Annual Meeting on our strategy and areas of focus and progress in 2021, as well as plans for the future of Duke Energy. We have made progress over the past year on our path to reach our goals to achieve at least 50% reduction in CO2 emissions by 2030 from electricity generation and net-zero CO2 emissions by 2050 from electricity generation, as well as the goal of our natural gas local distribution business to reach net-zero methane emissions by 2030. In addition, earlier this year we announced the expansion of our net-zero by 2050 goal to include Scope 2 emissions and certain Scope 3 emissions. We also announced a goal to exit coal generation by 2035, subject to regulatory approvals. The progress we made in 2021 on our climate strategy and further details on our goals are discussed in this proxy statement. | |

As a result of positive feedbackshareholders from our shareholders, we are excited to once again hold this year's Annual Meeting via live webcast. This format will continue to enable us to use technology to open our Annual Meeting to shareholders all over the world and improve our communications with them while still providing themyou the same opportunities to vote and ask questions that theyyou would have had at previousan in-person meetings. Once again, we will use a pre-meeting forum onproxyvote.com to enable shareholders to submitmeeting, including by submitting questions in writing in advance of the Annual Meeting.Meeting on our pre-meeting forum at proxyvote.com. An audio broadcast of the Annual Meeting will also be available by phone toll-free at 1.800.239.9838, conference number 7668330.800.289.0720, confirmation code 6176182. Details regarding how to participate in the Annual Meeting via live webcast, andas well as the items to be voted on, are more fully described in the accompanying Notice of Annual Meeting of Shareholders, “Rules of Conduct for the Annual Meeting” on page 1 of the Proxy Summary, and in the Frequently“Frequently Asked Questions and Answers About the Annual MeetingMeeting” on page 7276 of this proxy statement.

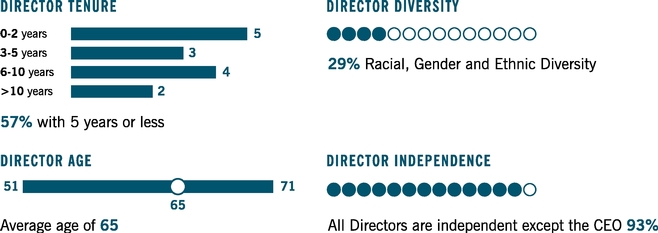

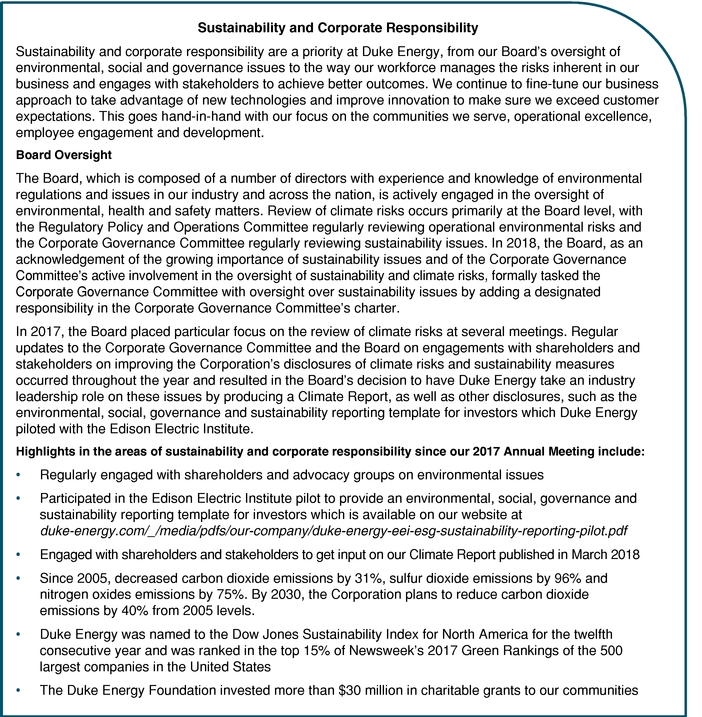

This proxy statement contains details about our strong corporate governance and executive compensation practices. We have made numerous positive changes to our governance practices in recent years. These changes are in addition to the progress made on implementing the Corporation's strategy in 2017 which is further detailed in the 2017 Annual Report that accompanies this proxy statement.

Your participation as a shareholder is important to us.

Annual Meeting.

![[MISSING IMAGE: sg_lynnjgood-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/sg_lynnjgood-bw.jpg)

Lynn J. GoodChairman,Chair, President and Chief Executive OfficerCEO

![]()

Letter from the Board of Directors

![[MISSING IMAGE: ph_michaelgbrownnew1-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_michaelgbrownnew1-4c.jpg)

Dear Fellow Shareholders:

Shareholders:

The focus of these conversations in 2017 involved our corporate strategy, compensation and governance practices, the composition of our Board and the progress to date on environmental and sustainability goals. Membersindependent members of the Board were present in many of these conversations and feedback from shareholders was discussed by the Board.

Shareholders also expressed a desire to learn more about how we are mitigating risks from climate change. In response to this feedback, and with leadership and oversight by the Board, we published a Climate Report in March 2018. The publication of this report is a testament to the Board's commitment to act on shareholder feedback and is in addition to other changes we have made in recent years, including the Board's adoption of majority voting for the election of directors, proxy access and the ability for shareholders to call special shareholder meetings and act by written consent. These changes reflect the Board's commitment to evolve our compensation and governance practices to align with best practices and to honor the perspectives of our shareholders.

Throughout the year, I have had the privilege of working with an engaged and experienced group of directors. The diversity of experience, background and skills present in the boardroom allows for active Board oversight of the most important issues facing Duke Energy as we navigate and make progress on our strategic initiatives. The Board strikes the right balance between fresh perspectives and established experience. Since 2014, we have added six new directors to the Board. This mix of new ideas and experiences has resulted in a dynamic Board uniquely equipped to lead Duke Energy as it navigates the rapid changes occurring in the utility industry. I have been honored to lead this Board as Independent Lead Director for the past two years and to work closely with our Chief Executive OfficerChair, President and CEO, Lynn Good, who has skillfully positioned Duke Energy as a leader while the utility industry navigates rapid changes. We are a diverse, engaged, and experienced group of directors who are deeply committed to sound corporate governance, human capital management, executive compensation, and risk management policies and practices to ensure that Duke Energy operates responsibly and efficiently and achieves long-term sustainable value for our fellow shareholders. The varied perspectives of this Board allow us to actively oversee the most important issues facing Duke Energy.

our Company. We look forward to continuing our dialogue with you. On behalf ofshareholders at the entire Board, thank you for your continued support.

2022 Annual Meeting and throughout the year.

Michael G. BrowningIndependent Lead Director

![]()

| | Michael G. Browning Derrick Burks Annette K. Clayton Theodore F. Craver, Jr. Robert M. Davis Caroline Dorsa | | | W. Roy Dunbar Nicholas C. Fanandakis John T. Herron Idalene F. Kesner | | | E. Marie McKee Michael J. Pacilio Thomas E. Skains William E. Webster, Jr. | |

![]()

| | Notice of 2022 Annual Meeting of | | | |

| | Items of Business | | | Board’s Voting Recommendation | | | ||||||

| | 1 | | | Election of Directors | | | | | ||||

| | 2 | | | Ratification of Deloitte & Touche LLP as Duke Energy’s independent registered public accounting firm for 2022 | | | | | | | | |

| | 3 | | | Advisory vote to approve Duke Energy’s named executive officer compensation | | | | | | | | |

| | 4 | | | Shareholder proposal, if properly presented at the meeting | | | | | | | | |

| | 5 | | | Any other business that may properly come before the meeting (or any adjournment or postponement of the meeting) | | | | | | |||

| | Vote Now | | |||

| | By Internet | | | By Mailing Your Proxy Card | |

| | Visit 24/7 proxyvote.com | | | Vote, sign your proxy card, and mail free of postage | |

| | By Phone | | | Participate in the Annual Meeting | |

| | Call toll free 24/7 at 800.690.6903 or by calling the number provided by your broker, bank, or other nominee if your shares are not registered in your name | | | You will need the 16-digit control number, which can be found on your Notice, on your proxy card, and on the instructions that accompany your proxy materials | |

| | | ||||

We will convene the Annual Meeting March 7, 2022

The purpose of the Annual Meeting is to consider and take action on the following:

Shareholders of recordcommon stock as of the close of business on March 9, 2018,the record date are entitled to participate in, vote, and ask questions at the Annual Meeting by visitingMeeting.

This year Because we again plan to providewill be providing our proxy materials to our shareholders electronically. By doing so,electronically, most of our shareholders will receive only receive the Notice containing instructions on how to access the proxy materials electronically and vote online, by phone, or by mail. If you would like to request paper copies of the proxy materials, you may follow the instructions on theyour Notice. If you receive paper copies of the proxy materials, we ask you to consider signing up to receive these materials electronically in the future by following the instructions contained in this proxy statement. By delivering proxy materials electronically, we can reduce the consumption of natural resources and the cost of printing and mailing our proxy materials.

Please take time to vote now. If you choose to vote by mail, you may do so by marking, dating and signing the proxy card and returning it to us. Please follow the voting instructions that are included on your proxy card. Regardless of the manner in which you vote, we urge and greatly appreciate your prompt response.

| | |||||

| Dated: March | | | By order of the Board of Directors, | | |

| | | | | ![[MISSING IMAGE: sg_kodwogharteytagoe-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/sg_kodwogharteytagoe-bw.jpg) | |

| | | | | Kodwo Ghartey-Tagoe Executive Vice President, | |

DUKE ENERGY – 2018 Proxy Statement

| | DUKE ENERGY | | | BUILDING A | |

| | | Duke Energy strives to provide our shareholders at the online-only Annual Meeting the same rights that they would have had at an in-person meeting and an enhanced opportunity for participation and discourse. • Shareholders who have submitted a proposal for the Annual Meeting are given the choice of recording the presentation of their proposal in advance or presenting their proposal live via a third-party operated telephone line. • A representative of Broadridge Financial Solutions has been appointed as the independent inspector of elections. • Shareholders as of the record date who would like to submit questions in writing in advance of the Annual Meeting may do so by visiting our pre-meeting forum at proxyvote.com using their 16-digit control number. • Shareholders participating in the Annual Meeting live via webcast may also submit questions in writing during the Annual Meeting. Shareholders are encouraged to provide their name and contact information in case the Company needs to contact them after the Annual Meeting. • Individuals who are not shareholders as of the record date who are interested in viewing or listening to the Annual Meeting will be allowed to check-in to duke-energy.onlineshareholdermeeting.com to view the Annual Meeting as a guest, or listen to the Annual Meeting toll-free at 800.289.0720, confirmation code 6176182. • Questions submitted by shareholders will be read during the Annual Meeting unedited. Of course, questions that are of an inappropriate personal nature or that use offensive language will not be read at the Annual Meeting or posted on our website after the Annual Meeting. Questions regarding technical issues related to the Annual Meeting will be referred to technical support personnel to respond separately. Similarly, questions regarding the availability or location of proxy materials will be responded to separately. • We will post answers to all questions received in advance of or during the Annual Meeting, including those questions that we do not answer during the Annual Meeting, on our website at duke-energy.com/our-company/investors/financial-news under “05/05/2022 – Annual Meeting of Shareholders.” All unedited questions and the answers to those questions, as well as a video replay of the Annual Meeting, will be available on our website until the release of the proxy statement for the 2023 Annual Meeting. • Questions on topics that have been previously asked and answered during the Annual Meeting will be answered after the Annual Meeting and posted on our website at duke-energy.com/our-company/investors/financial-news under “05/05/2022 – Annual Meeting of Shareholders” along with all other submitted questions. • The Question and Answer portion of the Annual Meeting will end upon the earlier of 2:00 p.m. Eastern time, or after all question topics that are not of an inappropriate nature have been answered. | | |

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 1 | |

| | Headquartered in Charlotte, North Carolina, Duke Energy is one of the largest energy holding companies in the United States, providing electricity to approximately 8.2 million retail electric customers in six states and natural gas distribution services to 1.6 million customers in five states. We own approximately 50,259 MW of electric generating capacity in North Carolina, South Carolina, the Midwest, and Florida, and approximately 3,554 MW of generating capacity through our commercial renewables business, which owns and operates diverse power generation assets throughout North America, including a portfolio of renewable wind, solar, energy storage, and microgrid projects. More information about Duke Energy is available on our website at duke-energy.com. | | | ![[MISSING IMAGE: tm221429d1-fc_whowearepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-fc_whowearepn.jpg) | |

| | | | | | | | Broker Non-Votes* | | | Abstentions | | | Votes Required for Approval | |

| | ||||||||||||||

| | | Proposal 1: Election of Directors (page 11) The Board recommends you vote FOR each Nominee | | | Do not count | | | Do not count | | | Majority of votes cast, with a resignation policy | | ||

| | | | Proposal 2: Ratification of Deloitte & Touche LLP as Duke Energy’s independent registered public accounting firm for 2022 (page 39) The Board recommends you vote FOR this proposal | | | Brokers have discretion to vote | | | Vote against | | | Majority of shares represented | | |

| | | | Proposal 3: Advisory vote to approve Duke Energy’s named executive officer compensation (page 41) The Board recommends you vote FOR this proposal | | | Do not count | | | Vote against | | | Majority of shares represented | | |

| | | | Proposal 4: Shareholder proposal regarding shareholder right to call for a special shareholder meeting (page 73) The Board recommends you vote AGAINST this proposal | | | Do not count | | | Vote against | | | Majority of shares represented | |

DUKE ENERGY – 2018 Proxy Statement

PARTICIPATE IN THE FUTURE OF DUKE ENERGY; CAST YOUR VOTE NOW

It is very important that you vote to participate in the future of Duke Energy Corporation ("Duke Energy" or the "Corporation"). New York Stock Exchange ("NYSE")

Eligibility to Vote

You can vote if you were a shareholder of record at the close of business on March 9, 2018.

Vote Now

Even if you plan to participate in this year's Annual Meeting, it is a good idea to vote your shares before the Annual Meeting in the event your plans change. Whether you vote online, by phone or by mail, please have your proxy card or instructions that accompanied your proxy materials in hand and follow the instructions.

|  |  | ||

Participate in the Annual Meeting

This year's Annual Meeting will be held exclusively via live webcast enabling shareholders from around the world to participate, submit questions in writing and vote. Shareholders of record as of the close of business on March 9, 2018, are entitled to participate in and vote at the Annual Meeting by visitingduke-energy.onlineshareholdermeeting.com. To participate in the Annual Meeting via live webcast, you will need the 16-digit control number included on your Notice, on your proxy card and on the instructions that accompanied your proxy materials. The Annual Meeting will begin promptly at 12:30 p.m. Eastern Time. Online check-in will begin at 12:00 p.m. Eastern Time. Please allow ample time for the online check-in procedures. An audio broadcast of the Annual Meeting will be available by phone toll-free at 1.800.239.9838, conference number 7668330.

Shareholders who would like to submit questions in writing in advance of the Annual Meeting can do so by visiting our pre-meeting forum atproxyvote.com using your 16-digit control number. We will post answers to all questions received in advance of or during the Annual Meeting, including those questions that we do not have time to answer during the Annual Meeting, to our website atduke-energy.com/our-company/investors/financial-newsunder "May 3, 2018 - 2018 Annual Meeting of Shareholders".

2 DUKE ENERGY – 2018 Proxy Statement

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. Page references ("XX") are supplied to help you find further information in this proxy statement.

Voting Matters

| | 2 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

![[MISSING IMAGE: tm221429d1-tbl_purposepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-tbl_purposepn.jpg)

| | | Our Greenhouse Gas Emission Reduction Goals | | | |||||||||||

| | | 2030 | | | | | | | • At least 50% reduction in CO2 emissions from 2005 levels from electricity generation (Scope 1 emissions) | | | ||||

| | Natural Gas Local Distribution Business | | | | • Reduction in methane emissions to net-zero (Scope 1 emissions) | | | ||||||||

| | | ||||||||||||||

| | | | | | | • Net-zero CO2 emissions from electricity generation (Scope 1 emissions) | |||||||||

Net-zero CO2 emissions from electricity purchased for Company use (Scope 2 emissions) • Net-zero greenhouse gas emissions from the power we purchase for resale and from the procurement of fossil fuels used for generation (Scope 3 emissions) | | ||||||||||||||

| | Natural Gas Local Distribution Business | | | | • Net-zero emissions from upstream methane and carbon emissions related to purchased gas and downstream carbon emissions from customers’ consumption (Scope 3 emissions) | | | ||||||||

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 3 | | |||||||

| | | 27,605 Employees | | | | 18.3% Union | | | | |||

| | | | 19.6% People of Color | | |

![[MISSING IMAGE: tm221429d1-pc_typespn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-pc_typespn.jpg)

Duke Energy Overview

Headquartered in Charlotte, North Carolina, Duke EnergyThe Company is one of the largest energy holding companies in the United States. Our Electric Utilities and Infrastructure business serves approximately 7.6 million customers located in six states in the Southeast and Midwest. Our Gas Utilities and Infrastructure business distributes natural gas to approximately 1.5 million customers in the Carolinas, Ohio, Kentucky and Tennessee. Our Commercial Renewables business operates a growing renewable energy portfolio across the United States. More informationbeing intentional about our business is available atduke-energy.com.

2017 Business Highlights

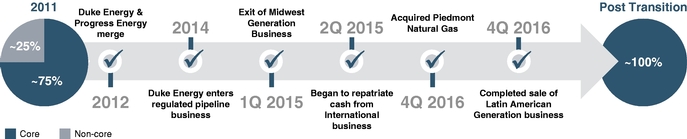

actions to support our employees and attract diverse talent. We entered 2017 in a position of strength, having completedwork hard to help ensure that all employees feel that they have an equitable and inclusive experience by leveraging our multi-year transformation to exitemployee resource groups, as well as diversity and inclusion councils.

| | Support for Employee Well-Being | | | We support our employees physically, emotionally, and financially through our wellness and mental health programs and provide webinars and coaching focused on improving financial wellness. | |

| | Diversity & Inclusion Learning Programs | | | We have developed a portfolio of training for all employees to build our knowledge and understanding of diversity, equity, and inclusion, and build skills and capabilities for creating a more inclusive workplace. | |

| | Fair and Equitable Compensation | | | The Company is committed to providing market competitive, fair, and equitable compensation by regularly reviewing employee pay. We conduct internal pay equity reviews and benchmarking against peer companies to ensure our pay is competitive. | |

| | Attracting Diverse Talent | | | We continuously evaluate our practices across the hiring life cycle to attract a talented and diverse workforce to deliver on our commitments to customers. We have a dedicated team focused on building relationships with four-year colleges and technical schools, as well as community organizations to strengthen diversity in our future pipeline of talent. In 2021, we partnered to create a HBCU Energy Leadership Pathway pilot program with four HBCUs located in North Carolina and South Carolina. This program will provide students of color with mentoring, internships, and access to the rapidly evolving clean energy workforce. | |

| | Courageous Conversations | | | “Let’s Talk About It” is a series of organized employee events the Company held around difficult but necessary and thought-provoking topics that help build understanding and awareness and support an inclusive workplace. In 2021, we had 50 sessions with nearly 6,000 employees attending. | |

| | 4 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

![[MISSING IMAGE: tm221429d1-tbl_businepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-tbl_businepn.jpg)

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 5 | |

In conjunction with our strategic accomplishments, we maintained a sharp focus during the year on operational excellence, including:

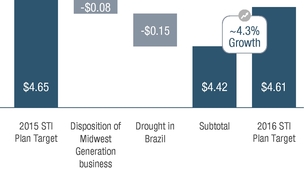

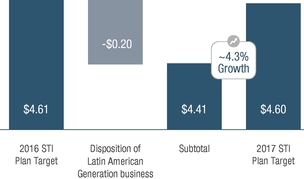

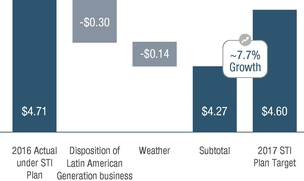

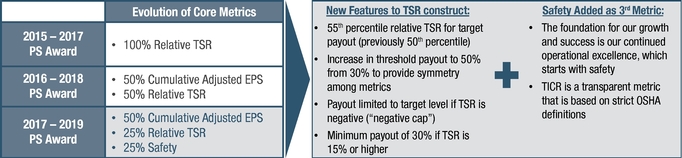

Our strategic and operational accomplishments contributed to strong financial performance for the year. We demonstrated flexibility in the management of our spending to offset the impact of an extraordinarily mild 2017 Winter season. Despite the significant headwind from weather, including Hurricane Irma impacts, we delivered on our earnings guidance for the year. Additionally, our total shareholder return was 13.0% in 2017, compared to 13.5% in 2016. The total shareholder return of the Philadelphia Utility Index ("UTY") was 12.8% in 2017, compared to 17.4% in 2016.

During 2017, we increased the dividend payment to our shareholders by approximately 4%, reflecting our confidence in the strength of our businesses and commitment to return value to shareholders. This is the eleventh consecutive year of annual dividend growth. 2017 also marked the ninety-first consecutive year that Duke Energy has paid a quarterly cash dividend on our common stock, a record we expect to continue for shareholders who rely on a steady and growing dividend.

| | | 1 | | | Environmental The Company's progress on its goal to reach net-zero carbon emissions from electricity generation by 2050 | |

| | | 2 | | | Social Our human capital management and diversity, equity, and inclusion initiatives | |

| | | 3 | | | Governance Board oversight, diversity, skills, and the changes to the Company's Political Expenditures Policy | |

| | • Annual ESG Report (formerly known as the Sustainability Report) • 2017 and 2020 Climate Reports, which are aligned with the recommendations of the TCFD • Semi-annual Corporate Political Expenditures Report | | | • Annual Trade Association Climate Review • SASB disclosures • EEI/AGA template disclosure • GRI disclosures | |

4 DUKE ENERGY – 2018 Proxy Statement

Board Nominees (page 9)

| Name | Age | Gender, Racial or Ethnically Diverse | Director since | Occupation | Independent | Committee Memberships | Other Public Company Boards | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | |

Michael G. Browning | 71 | | 2006 | Chairman, Browning Consolidated, LLC | ü | • Compensation • Corporate Governance (C) • Finance and Risk Management | • None | |||||||

| | | | | | | | | | | | | | | |

Theodore F. Craver, Jr. | 66 | 2017 | Retired Chairman, President and Chief Executive Officer, Edison International | ü | • Audit (C) • Finance and Risk Management | • Wells Fargo & Company | ||||||||

| | | | | | | | | | | | | | | |

Robert M. Davis | 51 | | 2018 | Chief Financial Officer and Executive Vice President, Global Services, Merck & Co., Inc. | ü | • Audit • Finance and Risk Management | • None | |||||||

| | | | | | | | | | | | | | | |

Daniel R. DiMicco | 67 | 2007 | Chairman Emeritus, Retired President and Chief Executive Officer, Nucor Corporation | ü | • Corporate Governance • Nuclear Oversight | • Hennessy Capital Acquisition Corp. III | ||||||||

| | | | | | | | | | | | | | | |

John H. Forsgren | 71 | | 2009 | Retired Vice Chairman, Executive Vice President and Chief Financial Officer, Northeast Utilities | ü | • Compensation • Finance and Risk Management (C) | • None | |||||||

| | | | | | | | | | | | | | | |

Lynn J. Good | 58 | ü | 2013 | Chairman, President and Chief Executive Officer, Duke Energy Corporation | • None | • The Boeing Company | ||||||||

| | | | | | | | | | | | | | | |

John T. Herron | 64 | | 2013 | Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear | ü | • Nuclear Oversight (C) • Regulatory Policy and Operations | • None | |||||||

| | | | | | | | | | | | | | | |

James B. Hyler, Jr. | 70 | 2012 | Retired Vice Chairman and Chief Operating Officer, First Citizens BancShares, Inc. | ü | • Audit • Regulatory Policy and Operations (C) | • None | ||||||||

| | | | | | | | | | | | | | | |

William E. Kennard | 61 | ü | 2014 | Non-Executive Chairman, Velocitas Partners, LLC | ü | • Corporate Governance • Finance and Risk Management | • AT&T Inc. • Ford Motor Company • MetLife, Inc. | |||||||

| | | | | | | | | | | | | | | |

E. Marie McKee | 67 | ü | 2012 | Retired Senior Vice President, Corning Incorporated | ü | • Compensation (C) • Corporate Governance | • None | |||||||

| | | | | | | | | | | | | | | |

Charles W. Moorman IV | 66 | | 2016 | Senior Advisor, Amtrak | ü | • Nuclear Oversight • Regulatory Policy and Operations | • Chevron Corporation | |||||||

| | | | | | | | | | | | | | | |

Carlos A. Saladrigas | 69 | ü | 2012 | Chairman, Regis HR Group | ü | • Audit • Compensation | • None | |||||||

| | | | | | | | | | | | | | | |

Thomas E. Skains | 61 | | 2016 | Retired Chairman, President and Chief Executive Officer, Piedmont Natural Gas Company, Inc. | ü | • Nuclear Oversight • Regulatory Policy and Operations | • BB&T Corporation • National Fuel Gas Company | |||||||

| | | | | | | | | | | | | | | |

William E. Webster, Jr. | 64 | 2016 | Retired Executive Vice President, Industry Strategy for the Institute of Nuclear Power Operations | ü | • Nuclear Oversight • Regulatory Policy and Operations | • None | ||||||||

| | | | | | | | | | | | | | | |

![[MISSING IMAGE: tm221429d1-tbl_esghighpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-tbl_esghighpn.jpg)

| | 6 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

DUKE ENERGY – 2018 Proxy Statement 5

6 DUKE ENERGY – 2018 Proxy Statement

Board Representation

| | Independence | | | | • Independent Lead Director with clearly defined roles and responsibilities • Independent Board committees • Independent directors meet in executive session at each regularly scheduled Board meeting | |

| | Shareholder Rights | | | |||

| | • Ability for shareholders to nominate directors through proxy access | |||||

| ||||||

Robust year-round shareholder engagement program, | ||||||

| involvement | ||||||

• Ability for shareholders to take action by less than unanimous written consent | ||||||

| ||||||

Ability for shareholders to call a special shareholder meeting • Board responsiveness to majority support of shareholder proposals • Each share of common stock is equal to one vote | | |||||

| | Good Governance Practices | | | |||

| | • Majority voting for directors with mandatory resignation policy and plurality carve out for contested elections • Annual Board, committee, and director assessments • Clearly defined environmental and social initiatives and goals | |||||

| ||||||

Annual election of all directors | ||||||

• Policy to prohibit all hedging and pledging of corporate securities • Regular Board refreshment | | |||||

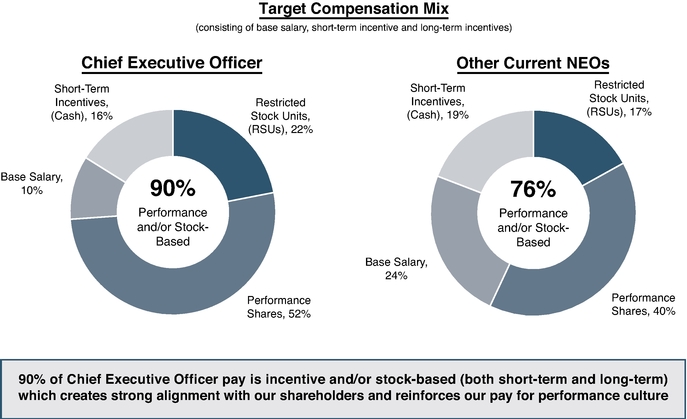

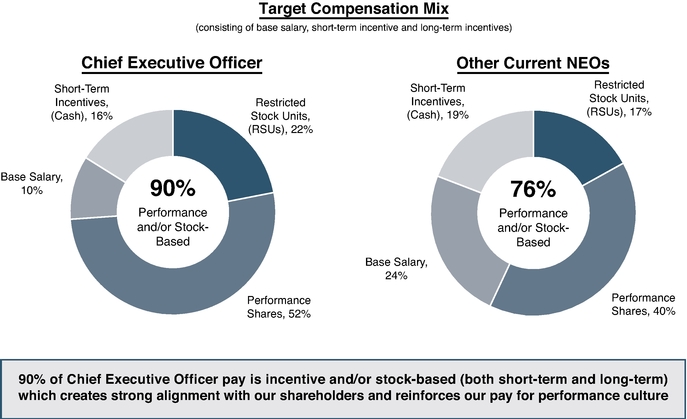

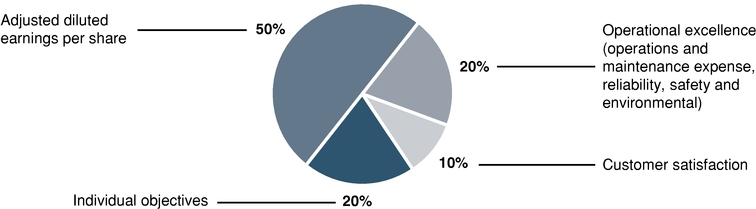

42) Our executive compensation program is designed to:36)Principles and Objectives•

| | | 1 | | | Link Pay to Performance | |

| | | 2 | | | Attract and Retain talented executive officers and key employees | |

| | | 3 | | | Emphasize Performance-Based Compensation to motivate executives and key employees | |

| | | 4 | | | Reward Individual Performance | |

| | | 5 | | | Encourage Long-Term Commitments to Duke Energy and align the interests of executives with shareholders | |

We meet these objectives through the appropriate mix of compensation, including:

DUKE ENERGY – 2018 Proxy Statement 7

Key Executive Compensation Features (pages 37performance shares and 41)RSUs.

| | ||

| | | |

| | COMPENSATION COMPONENTS | | |||||||||

| | | | |||||||||

| | Base | | STI | | | LTI | | ||||

| | Link pay to performance | | | | | | | | | ||

| | Attract and retain talented executives and key employees | | | | | | | | |||

| | Emphasize performance-based compensation to motivate executives and key employees | | | | | | | | | ||

| | Reward individual performance | | | | | | | | | ||

| | | ||||||||||

| | | ||||||||||

| |||||||||||

| | | | |||||||||

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 7 | |

| | | | |||

| | |||||

| | | ||||

AT DUKE ENERGY WE… | | AT DUKE ENERGY WE DO NOT… | | ||

| | Integrate key performance metrics in our incentive plans relating to environmental, climate, safety, and customer initiatives | | | Provide tax gross-ups to NEOs | |

| | Require significant stock ownership, including 6x base salary for our CEO and 3x base salary for other NEOs | | | Permit hedging or pledging of Duke Energy securities | |

| | Maintain a stock retention policy | | | Provide “single trigger” vesting of stock awards upon a change in control | |

| | Tie equity and cash-based incentive compensation to a clawback policy | | | Provide employment agreements to a broad group | |

Use an independent compensation consultant retained by and reporting directly to the Compensation and People Development Committee to advise on compensation matters | | Encourage excessive or inappropriate risk-taking through our compensation program | | ||

| | Review tally sheets on an annual basis | | | Provide excessive perquisites | |

| | Consider shareholder feedback and the prior year’s “say-on-pay” vote | | | Provide dividend equivalents on unearned performance shares | |

| | Require that equity awards must be subject to a one-year minimum vesting period, subject to limited exceptions | | | | |

| | Disclose performance targets for | | | | |

![[MISSING IMAGE: tm221429d1-pc_targetpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-pc_targetpn.jpg)

| | 8 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

| | | | |||||||||||||||||||||||||||

| | Name | ||||||||||||||||||||||||||||

| | | Gender Diversity | | | Racial, or Ethnic Diversity | | | Other Public Boards | | | Audit | | | Compensation and People Development | | | Corporate Governance | | | Finance and Risk Management | | | Operations and Nuclear Oversight | | |||||

| | | | Derrick Burks Independent, 65, 2022 Retired Managing Partner of Ernst & Young, LLP, Indianapolis office | | | | | | X | | | Equity LifeStyles Properties ELS and Kite Realty Group Trust KRG | | | ● | | | | | | | | | ● | | | | | |

| | | | Annette K. Clayton Independent, 58, 2019 President and CEO, North America Operations, Schneider Electric SA | | | X | | | | | | NXP Semiconductors N.V. | | | ● | | | | | | | | | | | | ● | | |

| | | | Theodore F. Craver, Jr. Independent, 70, 2017 Retired Chairman, President and CEO, Edison International | | | | | | | | | Wells Fargo & Company | | | C | | | | | | | | | ● | | | | | |

| | | | Robert M. Davis Independent, 55, 2018 President and CEO, Merck | | | | | | | | | Merck | | | | | | | | | ● | | | C | | | | | |

| | | | Caroline Dorsa Independent, 62, 2021 Retired Executive Vice President and CFO, Public Service Enterprise Group Incorporated | | | X | | | | | | Biogen Inc., Illumina, Inc., and Intellia Therapeutics, Inc. | | | ● | | | ● | | | | | | | | | | | |

| | | | W. Roy Dunbar Independent, 60, 2021 Retired Chairman and CEO of Network Solutions, LLC | | | | | | X | | | Johnson Controls International, PLC and SiteOne Landscape Supply, Inc. | | | | | | ● | | | | | | | | | ● | | |

| | | | Nicholas C. Fanandakis Independent, 65, 2019 Retired Executive Vice President, DuPont de Nemours, Inc. (fka DowDuPont, Inc.) | | | | | | | | | FTI Consulting, Inc. and ITT Inc. | | | ● | | | | | | | | | ● | | | | | |

| | | | Lynn J. Good Executive Director, 62, 2013 Chair, President and CEO, Duke Energy Corporation | | | X | | | | | | The Boeing Company | | | | | | | | | | | | | | | | | |

| | | | John T. Herron Independent, 68, 2013 Retired President, CEO and Chief Nuclear Officer, Entergy Nuclear | | | | | | | | | None | | | | | | | | | | | | ● | | | C | | |

| | | | Idalene F. Kesner Independent, 64, 2021 Dean, Indiana University Kelley School of Business | | | X | | | | | | Berry Global Group, Inc. and Olympic Steel, Inc. | | | | | | | | | ● | | | | | | ● | | |

| | | | E. Marie McKee Independent, 71, 2012 Retired Senior Vice President, Corning Incorporated | | | X | | | | | | None | | | | | | C | | | ● | | | | | | | | |

| | | | Michael J. Pacilio Independent, 61, 2021 Retired Executive Vice President and COO, Exelon Generation, Exelon Corp. | | | | | | | | | None | | | | | | | | | | | | ● | | | ● | | |

| | | | Thomas E. Skains Independent, 65, 2016 Retired Chairman, President and CEO, Piedmont Natural Gas Company, Inc. | | | | | | | | | National Fuel Gas Company and Truist Financial Corporation | | | | | | ● | | | ● | | | | | | | | |

| | | | William E. Webster, Jr. Independent, 68, 2016 Retired Executive Vice President, Institute of Nuclear Power Operations | | | | | | | | | None | | | | | | | | | ● | | | | | | ● | |

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 9 | |

![[MISSING IMAGE: tm221429d1-bc_boardcompn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-bc_boardcompn.jpg)

TableDiversity of ContentsSkills, Qualifications, and Experience*

| | | | | | | | | | | |

| | | | | Customer Service experience is important as Duke Energy focuses on meeting customer expectations and transforming the customer experience. | | | | 9 | | |

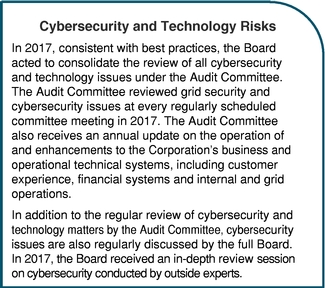

| | | | | Cybersecurity/Technology experience is important in overseeing the security of Duke Energy’s business and operational technical systems, including customer experience, financial systems, and internal and grid operations. | | | | 9 | | |

| | | | | ESG experience is important as incorporating sustainable business operations into our Duke Energy’s actions is vital to the success of our strategy. | | | | 11 | | |

| | | | | Human Capital Management experience is important in overseeing the needs of our workforce – Duke Energy’s most critical resource. | | | | 6 | | |

| | | | | Industry experience is important in understanding the unique technical, regulatory, and financial aspects of the utility industry. | | | | 9 | | |

| | | | | Regulatory/Government experience is important in understanding the regulated nature of the utility industry, including environmental regulations. | | | | 12 | | |

| | | | | Risk Management experience is important in overseeing a myriad of risks, including operational, financial, strategic, and reputational risks that affect our business. | | | | 13 | |

| 10 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A | |

If any director is unable to stand for election, the Board may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute

The Corporation's

Duke Energy.

DUKE ENERGY – 2018 Proxy Statement 9

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 11 | |

Derrick Burks | | |||||||||

| | ||||||||||

![[MISSING IMAGE: ph_derrickburks-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_derrickburks-4c.jpg) | | | ||||||||

| Age: Director of Duke Energy since | | | Committees: •

Audit Committee •

Finance and Risk Management Committee Other current public directorships: • Equity LifeStyles Properties ELS Kite Realty Group Trust KRG | | |||||

| Skills and qualifications: | |||||

| | | |||||

| |

| ||||

Mr. | ||||||

| | | |||||

Annette K. Clayton | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_annettekclaytnew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_annettekclaytnew-4c.jpg) | | | Age: 58 Director of Duke Energy since 2019 President and CEO, North America Operations, Schneider Electric SA | | | Committees: • Audit Committee • Operations and Nuclear Oversight Committee Other current public directorships: • NXP Semiconductors N.V. | |

| | | Skills and qualifications: | | |

| | | Ms. Clayton’s qualifications for election include her experience as senior management of Schneider Electric overseeing the strategic direction and financial accountability of the company’s North America operations. In her role as President and CEO of Schneider Electric’s North America Operations, she has gained experience in customer service through her direct responsibility for the customer call centers, in cybersecurity and technology through Schneider Electric’s work with the government on cybersecurity infrastructure, and the digital transformation of their supply chain, and in environmental regulations, clean energy and ESG issues through work with Schneider Electric’s sustainability division, through her oversight of Schneider Electric’s Safety and Environment function, and as a Thought Leader on sustainable procurement for manufacturing with the World Economic Forum in Davos, Switzerland. She also has human capital management experience through her work on talent management initiatives, succession planning, and supply chain workforce planning at Schneider Electric. These skills uniquely fit the skillsets that benefit Duke Energy in our corporate strategy. | | |

| | 12 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

Theodore F. Craver, Jr. | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_theodorefcravenew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_theodorefcravenew-4c.jpg) | | | Age: 70 Director of Duke Energy since 2017 Retired Chairman, President and CEO, Edison International | | | Committees: • Audit Committee (Chair) • Finance and Risk Management Committee Other current public directorships: • Wells Fargo & Company | |

| | | Skills and qualifications: | | |

| | | Mr. Craver’s qualifications for election include his experience as CEO of Edison International, which gives him in-depth knowledge of the utility industry and the regulatory arena, including environmental regulations, as well as his financial and risk management experience obtained as a |

10 DUKE ENERGY – 2018 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| | | |||

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 13 | |

Robert M. Davis | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_robertmdavisnew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_robertmdavisnew-4c.jpg) | | | Age: Director of Duke Energy since 2018 | | | Committees: •

Corporate Governance Committee • Finance and Risk Management Committee (Chair) Other current public directorships: •

Merck | |

| Skills and qualifications: | | | |

| | Mr. | ||

| | | |||

Caroline Dorsa | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_caroldorsagrbg-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_caroldorsagrbg-4clr.jpg) | | | |||||

| Director of Duke Energy since | | | Committees: •

Audit Committee •

Compensation and People Development Committee Other current public directorships: • Biogen Inc. Illumina, Inc. • Intellia Therapeutics, Inc. | | ||

| Skills and qualifications: | | | |

| | | Ms. Dorsa’s qualifications for election include her financial acumen, her cybersecurity and technology experience, and her understanding of the regulatory and human capital management risks in the energy industry, gained during her time at Public Service Enterprise Group, where she served as a member of the board of directors, Executive Vice President and CFO, head of the finance department, and was directly responsible for the information technology and business development groups. | | |

| | 14 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

W. Roy Dunbar | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_roydunbarnew-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_roydunbarnew-4clr.jpg) | | | Age: 60 Director of Duke Energy since 2021 Retired Chairman and CEO of Network Solutions, LLC | | | Committees: • Compensation and People Development Committee • Operations and Nuclear Oversight Committee Other current public directorships: • Johnson Controls International, PLC • SiteOne Landscape Supply, Inc. | |

| | | Skills and qualifications: | | |

| | | Mr. | | |

Nicholas C. Fanandakis | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_nicholascfanannew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_nicholascfanannew-4c.jpg) | | | Age: 65 Director of Duke Energy since 2019 Retired Executive Vice President, DuPont de Nemours, Inc. | | | Committees: • Audit Committee • Finance and Risk Management Committee Other current public directorships: • FTI Consulting, Inc. • ITT Inc. | |

| | | Skills and qualifications: | | |

| | | Mr. Fanandakis’ qualifications for election include his management |

DUKE ENERGY – 2018 Proxy Statement 11

PROPOSAL 1: ELECTION OF DIRECTORS

| | | |||

|

| |||||

| | | | DUKE ENERGY 2022 PROXY STATEMENT 15 | | ||

Lynn J. Good | | ||||||

Non-Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_lynngoodbg-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_lynngoodbg-4c.jpg) | | | Age: Director of Duke Energy since 2013 Duke Energy Corporation | | | Committees: • None Other current public directorships: • The Boeing Company | |

| Skills and qualifications: | | | |

| | Ms. Good is our | | |

12 DUKE ENERGY – 2018 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

John T. Herron | | |||||||||

| | ||||||||||

![[MISSING IMAGE: ph_herronjohn-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_herronjohn-4clr.jpg) | | | ||||||||

| Age: Director of Duke Energy since 2013 Retired President, | | | Committees: • Finance and Risk Management Committee • Operations and Nuclear Oversight Committee (Chair)

Other current public directorships: • None | | |||||

| Skills and qualifications: | | |

| | Mr. | |

| |

| | 16 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

Idalene F. Kesner | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_idalenefkesner-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_idalenefkesner-4c.jpg) | | | Age: 64 Director of Duke Energy since 2021 Dean, Indiana University Kelley School of Business | | | Committees: • Corporate Governance Committee • Operations and Nuclear Oversight Committee Other current public directorships: • Berry Global Group, Inc. • Olympic Steel, Inc | |

| | | Skills and qualifications: | | |

| | | Dr. Kesner’s qualifications for election include her risk management, governance and strategy expertise obtained as part of her educational background, as well as her work on the boards of other highly regulated companies, and her customer service and regulatory knowledge obtained as a leader at Indiana University and a part of the Indiana state government. | | |

E. Marie McKee | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_mariemckeenew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_mariemckeenew-4c.jpg) | | | Director of Duke Energy since 2012 Retired Senior Vice Corning Incorporated | | | Committees: •

Compensation and People Development Committee (Chair) •

Corporate Governance Committee Other current public directorships: • None | |

| Skills and qualifications: | |||

DUKE ENERGY – 2018 Proxy Statement 13

PROPOSAL 1: ELECTION OF DIRECTORS

| | | |||||

|

| |||||

| | | |||||

|

| |||||

Ms. | ||||||

| | | |||||

14 DUKE ENERGY – 2018 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | DUKE ENERGY 2022 PROXY STATEMENT 17 | | ||

Michael J. Pacilio | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_michaelpacilio1-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_michaelpacilio1-4clr.jpg) | | | Age: Director of Duke Energy since Retired Executive Vice President and COO, Exelon Generation, Exelon Corp. | | | Committees: • Finance and Risk Management Committee • Operations and Nuclear Oversight Committee

Other current public directorships: •

None | |

| Skills and qualifications: | |||

| | | |||

|

| |||

Mr. | ||||

DUKE ENERGY – 2018 Proxy Statement 15

PROPOSAL 1: ELECTION OF DIRECTORS

| | | |||

Thomas E. Skains | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_thomasekainsnew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_thomasekainsnew-4c.jpg) | | | Age: Director of Duke Energy since 2016 Retired Chairman, President and Piedmont Natural Gas Company, Inc. | | | Committees: •

Compensation and People Development Committee •

Corporate Governance Committee Other current public directorships: •

National Fuel Gas Company • Truist Financial Corporation | |

| Skills and qualifications: | | | |

| | Mr. | | |

| 18 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

William E. Webster, Jr. | | ||||||

| Independent Director Nominee | | ||||||

![[MISSING IMAGE: ph_williamewebstnew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_williamewebstnew-4c.jpg) | | | |||||

| Age: Director of Duke Energy since 2016 Retired Executive Vice President, Institute of Nuclear Power Operations | | | Committees: • Corporate Governance Committee • Operations and Nuclear Oversight Committee

Other current public directorships: • None | | ||

| Skills and qualifications: | | | |

| | Mr. | | |

"FOR"“FOR” Each Nominee.

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 19 | |

Michael G. Browning serves as the Corporation's

SEC.

| | 20 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

For Mr. Webster, the Board considered a relationship between the Corporation and PriceWaterhouseCoopers ("PwC"), a firm that provides professional tax and other services from time to time to the Corporation and at which Mr. Webster's brother-in-law was a partner for the majority of 2017. In December 2017, Mr. Webster's brother-in-law left his partnership with PwC to join the board of directors of the Public Company Accounting Oversight Board. The Board determined

| | The Board met 10 times during 2021 and has met once so far in 2022. During 2021 Board meetings, our Board held five executive sessions with independent directors only. Directors are expected to attend at least 75% of Board meetings and the meetings of the committees upon which he or she serves. The overall attendance percentage for our directors was approximately 99% in 2021, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2021. Directors are also encouraged to attend the Annual Meeting. All directors who were directors at the time of last year’s Annual Meeting on May 6, 2021, attended the 2021 Annual Meeting. | | | ![[MISSING IMAGE: tm2025328d26-pc_att99pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm2025328d26-pc_att99pn.jpg) | |

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 21 | |

this prior relationship did not impair Mr. Webster's independence in 2017, and, because there is no longer any ongoing relationship, there is no related person transaction for Mr. Webster with PwC at this time.

See Related Person Transactions on page 75 for further information.

The Board of Duke Energy met five times during 2017 and has met once so far in 2018. The overall attendance percentage for our directors was approximately 96% in 2017, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2017. Directors are encouraged to attend the Annual Meeting. All of our directors who were directors at the time of last year's Annual Meeting on May 4, 2017, attended the 2017 Annual Meeting except Ann Maynard Gray who retired from the Board at the 2017 Annual Meeting and Michael J. Angelakis who resigned from the Board in 2017.

discussed in executive session.

skills, as well as more information on topics for the Board to focus on in the following year.

18 DUKE ENERGY – 2018 Proxy Statement

| | 22 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

Each

DUKE ENERGY – 2018 Proxy Statement 19

focus.

![[MISSING IMAGE: tm221429d1-tbl_boarddir2pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-tbl_boarddir2pn.jpg)

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 23 | |

| | 24 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

meet, as well as every shareholder who requested to meet with us.

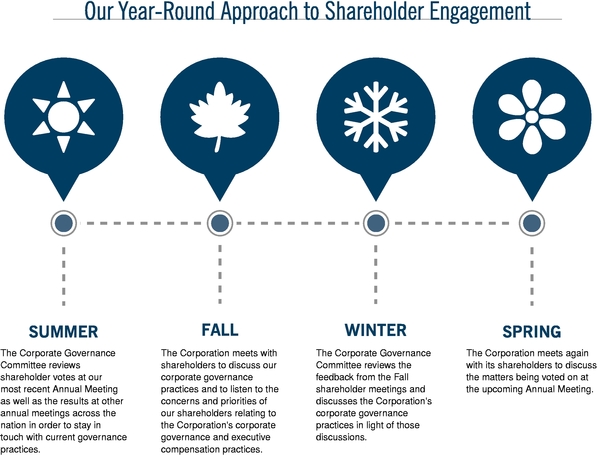

disclosures. During the Fall of 2017,2021, we focused our engagements with shareholders on explaining recent changesthe following topics:

DUKE ENERGY – 2018 Proxy Statement 21

this proxy statement; and the preparation of a Climate Report in 2022 to update shareholders on our progress toward our climate-related goals and to include additional net-zero analyses. Additional information on our discussions with shareholders regarding executive compensation matters is provided on page 42.

![[MISSING IMAGE: tm221429d1-fc_springpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-fc_springpn.jpg)

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 25 | |

| | |||||||||||||||||

| Name | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Audit | | | Compensation and People Development | | | Corporate Governance | | | Finance and Risk Management | | | Operations and Nuclear Oversight | | ||

| | Derrick Burks | | | ✓ | | | | | |||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

| | | | | ✓ | | | | | |||||||||

| | Michael G. Browning(2) | | | | | | ✓ | | | C | | | | | | | |

| | Annette K. Clayton | | | ✓ | | | | | | | | | | | | ✓ | |

| | Theodore F. Craver, Jr. | | | C | | | | | | | | | ✓ | | | | |

| | Robert M. Davis | | | | | | | | | ✓ | | | C | | | | |

| | Caroline Dorsa | | | ✓ | | | ✓ | | | | | | | | | | |

| | W. Roy Dunbar | | | | | | ✓ | | | | | | | | | ✓ | |

| | Nicholas C. Fanandakis | | | ✓ | | | | | | | | | ✓ | | | | |

| | Lynn J. Good | | | | | | | | | | | | | | | | |

| | John T. Herron | | | | | | | | | | | | ✓ | | | C | |

| | Idalene F. Kesner | | | | | | | | | ✓ | | | | | | ✓ | |

| | E. Marie McKee | | | | | | C | | | ✓ | | | | | | | |

| | Michael J. Pacilio | | | | | | | | | | | | ✓ | | | ✓ | |

| | Thomas E. Skains | | | | | | ✓ | | | ✓ | | | | | | | |

| | William E. Webster, Jr. | | | | | | | | | ✓ | | | | | | ✓ | |

| | 26 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

The Board has the six standing, permanent committees described below:

Eight meetings held in 2017

| | | Meetings in 2021: 7 | | | | | | | | |

| | | ![[MISSING IMAGE: ph_theodorefcravenew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_theodorefcravenew-4c.jpg) Theodore F. Craver, Jr. Chair | | | Committee Members | |||||

| Theodore F. Craver, Jr., Chair* Caroline Dorsa* Nicholas C. Fanandakis* *

Designated as an Audit Committee Financial Expert by the Board | | | ![[MISSING IMAGE: tm221429d1-pc_atten93pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-pc_atten93pn.gif) | | | ||||

Theodore F. Craver, Jr.

the Audit Committee in 2021.

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 27 | |

Six meetings held in 2017

| | | Meetings in 2021: 5 | | | | | | | | |

| | | ![[MISSING IMAGE: ph_mariemckeenew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_mariemckeenew-4c.jpg) E. Marie McKee Chair | | | Committee Members | |||||

| E. Marie McKee, Chair Michael G. Browning Thomas E. Skains | | | ![[MISSING IMAGE: tm221429d1-pc_atten95pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-pc_atten95pn.gif) | | |

E. Marie McKee

DUKE ENERGY – 2018 Proxy Statement 23

| | 28 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

Five meetings held in 2017

| | | Meetings in 2021: 7 | | | | | | | | |

| | | ![[MISSING IMAGE: ph_michaelgbrownnew1-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_michaelgbrownnew1-4c.jpg) Michael G. Browning Chair | | | Committee Members | |||||

| Michael G. Browning, Chair E. Marie McKee Thomas E. Skains William E. Webster, Jr. | | | ![[MISSING IMAGE: tm2025328d26-pc_atten100pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm2025328d26-pc_atten100pn.gif) | | |

Michael G. Browning

Four meetings held in 2017

| | | Meetings in 2021: 5 | | | | | | | | |

| | | ![[MISSING IMAGE: ph_robertmdavisnew-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_robertmdavisnew-4c.jpg) Robert M. Davis Chair | | | Committee Members | |||||

| Theodore F. Craver, Jr. Michael J. Pacilio | | | ![[MISSING IMAGE: tm2025328d26-pc_atten100pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm2025328d26-pc_atten100pn.gif) | | |

John H. Forsgren

24 DUKE ENERGY – 2018 Proxy Statement

Tablethe financial and risk implications of Contents

any significant transaction requiring Board approval.

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 29 | |

Four meetings held in 2017

| | | Meetings in 2021: 5 | | | | | | | | |

| | | ![[MISSING IMAGE: ph_herronjohn-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/ph_herronjohn-4clr.jpg) John T. Herron Chair | | | Committee Members | |||||

| John T. Herron, Chair Michael J. Pacilio William E. Webster, Jr. | | | ![[MISSING IMAGE: tm2025328d26-pc_atten100pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm2025328d26-pc_atten100pn.gif) | | |

John T. Herron

Regulatory Policy and Operations Committee

Four meetings held in 2017

|

James B. Hyler, Jr.

Each committee operates under a written charter adopted by the Board. The charters are posted onperformance of our websitegeneration assets atduke-energy.com/our-company/investors/corporate-governance/board-committee-charters.

DUKE ENERGY – 2018 Proxy Statement 25

| | 30 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

The Corporate Governance Committee’s charter is available on our website at duke-energy.com/our-company/investors/corporate-governance/board-committee-charters/corporate-governance and is summarized below. Additional information about the Corporate Governance Committee and its members is detailed on page 29 of this proxy statement.

Code of Business Ethics, either through our anonymous EthicsLine or otherwise, is provided on the Ethics section of our website at duke-energy.com/our-company/about-us/ethics.

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 31 | |

| | 32 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

DUKE ENERGY – 2018 Proxy StatementDirector Onboarding. 27

REPORT OF THE CORPORATE GOVERNANCE COMMITTEE

New Directors Since the 2017 Annual Meeting

Following the 2017 Annual Meeting at which one of the Corporation's directors, Ann Maynard Gray, retired in accordance with our Principles for Corporate Governance, as well as following the departure of Michael J. Angelakis from our Board in August 2017, the Corporate Governance Committee sought to recruit an additional Board member whose qualifications align with the needs ofmembers have joined the Board in light of the major risks and issues facing the Corporation, as well as our long-term strategy. After working with an independent search firm, the committee recommended in December 2017 that Robert M. Davis be appointedlast five years. In order to help those new directors quickly transition into their roles on the Board, effective January 8, 2018. Mr. Davis brings extensive financial and cybersecurity knowledge, along with experience working in an industry under going rapid transformation gained during his tenure as Chief Financial Officer of Merck & Co. and during his career at Baxter International. For more information on Mr. Davis' skills and qualifications, see page 11.

Director Onboarding. With the addition of a number of new directors to our Board over the past several years,

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 33 | |

![[MISSING IMAGE: tm2025328d26-fc_engagepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm2025328d26-fc_engagepn.jpg)

Corporate Governance Committee

28 DUKE ENERGY – 2018 Proxy Statement

| | 34 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

During its annual review of the non-employee director compensation program in 2017,2021, the Compensation and People Development Committee considered an analysis prepared by its independent consultant, FW Cook, which summarized non-employee director compensation trends for independent directors and pay levels at the same peer companies used to evaluate the compensation of our named executive officers.NEOs. Following this review, and after considering the advice of FW Cook about market practices and pay levels, the Compensation and People Development Committee recommended, and the Board approved, the followingdid not recommend any changes to our non-employee director compensation program:

following:

![[MISSING IMAGE: tm221429d1-pc_annualpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-pc_annualpn.jpg)

DUKE ENERGY – 2018 Proxy Statement 29

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 35 | |

| | Name | | | Fees Earned or Paid in Cash ($)(2) | | | Stock Awards ($)(3) | | | All Other Compensation ($)(4) | | | Total ($) | | ||||||||||||

| | Michael G. Browning | | | | | 205,000 | | | | | | 160,000 | | | | | | 4,681 | | | | | | 369,681 | | |

| | Annette K. Clayton | | | | | 125,000 | | | | | | 160,000 | | | | | | 2,638 | | | | | | 287,638 | | |

| | Theodore F. Craver, Jr. | | | | | 160,000 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 323,774 | | |

| | Robert M. Davis | | | | | 144,766 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 308,540 | | |

| | Daniel R. DiMicco (1) | | | | | 43,613 | | | | | | 0 | | | | | | 2,827 | | | | | | 46,440 | | |

| | Caroline D. Dorsa (1) | | | | | 81,387 | | | | | | 160,000 | | | | | | 1,179 | | | | | | 242,566 | | |

| | W. Roy Dunbar (1) | | | | | 81,387 | | | | | | 160,000 | | | | | | 3,679 | | | | | | 245,066 | | |

| | Nicholas C. Fanandakis | | | | | 135,000 | | | | | | 160,000 | | | | | | 1,274 | | | | | | 296,274 | | |

| | John T. Herron | | | | | 145,000 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 308,774 | | |

| | William E. Kennard (1) | | | | | 58,847 | | | | | | 0 | | | | | | 5,255 | | | | | | 64,102 | | |

| | Idalene F. Kesner (1) | | | | | 15,965 | | | | | | 75,165 | | | | | | 3,535 | | | | | | 94,665 | | |

| | E. Marie McKee | | | | | 145,000 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 308,774 | | |

| | Michael J. Pacilio (1) | | | | | 81,387 | | | | | | 160,000 | | | | | | 3,679 | | | | | | 245,066 | | |

| | Marya M. Rose (1) | | | | | 43,613 | | | | | | 0 | | | | | | 2,755 | | | | | | 46,368 | | |

| | Thomas E. Skains | | | | | 140,234 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 304,008 | | |

| | William E. Webster, Jr. | | | | | 125,000 | | | | | | 160,000 | | | | | | 3,774 | | | | | | 288,774 | | |

| | ||||||||||||||||||||||||||

| Name | | Fees Earned or Paid in Cash ($)(2) | | Stock Awards ($)(3) | | All Other Compensation ($)(4) | | Total ($) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | ||||||||

Michael J. Angelakis(1) | | | 99,903 | | | 160,000 | | | 2,674 | | | 262,577 | | ||||

Michael G. Browning | | | 190,077 | | | 160,000 | | | 6,269 | | | 356,346 | | ||||

Theodore F. Craver, Jr.(1) | | | 113,523 | | | 181,978 | | | 6,225 | | | 301,726 | | ||||

Daniel R. DiMicco | | | 129,077 | | | 160,000 | | | 6,269 | | | 295,346 | | ||||

John H. Forsgren | | | 147,577 | | | 160,000 | | | 6,269 | | | 313,846 | | ||||

Ann Maynard Gray(1) | | | 45,003 | | | 0 | | | 7,694 | | | 52,697 | | ||||

John T. Herron | | | 150,374 | | | 160,000 | | | 6,269 | | | 316,643 | | ||||

James B. Hyler, Jr. | | | 145,077 | | | 160,000 | | | 1,269 | | | 306,346 | | ||||

William E. Kennard | | | 134,077 | | | 160,000 | | | 6,269 | | | 300,346 | | ||||

E. Marie McKee | | | 149,374 | | | 160,000 | | | 6,269 | | | 315,643 | | ||||

Charles W. Moorman IV | | | 125,077 | | | 160,000 | | | 6,269 | | | 291,346 | | ||||

Carlos A. Saladrigas | | | 131,077 | | | 160,000 | | | 6,269 | | | 297,346 | | ||||

Thomas E. Skains | | | 130,077 | | | 160,000 | | | 6,269 | | | 296,346 | | ||||

William E. Webster, Jr. | | | 132,077 | | | 160,000 | | | 6,201 | | | 298,278 | | ||||

| | | | | | | | | | | ||||||||

| | Name | | | Business Travel Accident Insurance ($) | | | Charitable Contributions ($) | | | Other* ($) | | | Total ($) | | ||||||||||||

| | Michael G. Browning | | | | | 274 | | | | | | 3,500 | | | | | | 907 | | | | | | 4,681 | | |

| | Annette K. Clayton | | | | | 274 | | | | | | 2,364 | | | | | | 0 | | | | | | 2,638 | | |

| | Theodore F. Craver, Jr. | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | Robert M. Davis | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | Daniel R. DiMicco | | | | | 96 | | | | | | 2,500 | | | | | | 231 | | | | | | 2,827 | | |

| | Caroline D. Dorsa | | | | | 179 | | | | | | 1,000 | | | | | | 0 | | | | | | 1,179 | | |

| | W. Roy Dunbar | | | | | 179 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,679 | | |

| | Nicholas C. Fanandakis | | | | | 274 | | | | | | 1,000 | | | | | | 0 | | | | | | 1,274 | | |

| | John T. Herron | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | William E. Kennard | | | | | 96 | | | | | | 5,000 | | | | | | 159 | | | | | | 5,255 | | |

| | Idalene F. Kesner | | | | | 35 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,535 | | |

| | E. Marie McKee | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | Michael J. Pacilio | | | | | 179 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,679 | | |

| | Marya M. Rose | | | | | 96 | | | | | | 2,500 | | | | | | 159 | | | | | | 2,755 | | |

| | Thomas E. Skains | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | William E. Webster, Jr. | | | | | 274 | | | | | | 3,500 | | | | | | 0 | | | | | | 3,774 | | |

| | ||||||||||||||||||||||||||

| | 36 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

| Name | | Personal Use of Airplane ($) | | Business Travel Accident Insurance ($) | | Charitable Contributions ($) | | Retirement Gift ($) | | Total ($) | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |||||||||||||

Michael J. Angelakis | | | 0 | | | | 174 | | | | 2,500 | | | | 0 | | | 2,674 | | |||||

Michael G. Browning | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

Theodore F. Craver, Jr. | | | 0 | | | | 225 | | | | 6,000 | | | | 0 | | | 6,225 | | |||||

Daniel R. DiMicco | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

John H. Forsgren | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

Ann Maynard Gray | | | 0 | | | | 91 | | | | 7,500 | | | | 103 | | | 7,694 | | |||||

John T. Herron | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

James B. Hyler, Jr. | | | 0 | | | | 269 | | | | 1,000 | | | | 0 | | | 1,269 | | |||||

William E. Kennard | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

E. Marie McKee | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

Charles W. Moorman IV | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

Carlos A. Saladrigas | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

Thomas E. Skains | | | 0 | | | | 269 | | | | 6,000 | | | | 0 | | | 6,269 | | |||||

William E. Webster, Jr. | | | 0 | | | | 269 | | | | 5,932 | | | | 0 | | | 6,201 | | |||||

| | | | | | | | | | | | | |||||||||||||

30 DUKE ENERGY – 2018 Proxy Statement

| | ||||||||||||||

| Name or Identity of Group | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Total Shares Beneficially Owned(1) | | | Percent of Class | | |||||||

| | Michael G. Browning | | | | 102,837 | | | |||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| | | | * | | | ||||||||

| | Derrick Burks | | | | | 29 | | | | | | * | | |

| | Annette K. Clayton | | | | | 10,691 | | | | | | * | | |

| | Theodore F. Craver, Jr. | | | | | 9,943 | | | | | | * | | |

| | Robert M. Davis | | | | | 8,331 | | | | | | * | | |

| | Caroline Dorsa | | | | | 4,441 | | | | | | * | | |

| | W. Roy Dunbar | | | | | 1,591 | | | | | | * | | |

| | Nicholas C. Fanandakis | | | | | 5,280 | | | | | | * | | |

| | Kodwo Ghartey-Tagoe | | | | | 12,053 | | | | | | | | |

| | Lynn J. Good | | | | | 356,343 | | | | | | * | | |

| | John T. Herron | | | | | 24,681 | | | | | | * | | |

| | Dhiaa M. Jamil | | | | | 40,648 | | | | | | * | | |

| | Julia S. Janson | | | | | 38,064 | | | | | | * | | |

| | Idalene F. Kesner | | | | | 1,006 | | | | | | * | | |

| | E. Marie McKee | | | | | 169 | | | | | | * | | |

| | Michael J. Pacilio | | | | | 1,636 | | | | | | * | | |

| | Thomas E. Skains | | | | | 25,833 | | | | | | * | | |

| | William E. Webster, Jr. | | | | | 4,240 | | | | | | * | | |

| | Steven K. Young | | | | | 107,273 | | | | | | * | | |

| | Directors and executive officers as a group (26) | | | | | 798,615 | | | | | | * | | |

| | ||||||||

| | | | |||||

| Michael G. Browning | | | |||||

| | | ||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| | | ||||||

| | Derrick Burks | | | | | 286 | | |

| | Annette K. Clayton | | | | | 10,691 | | |

| | Theodore F. Craver, Jr. | | | | | 13,670 | | |

| | Robert M. Davis | | | | | 8,331 | | |

| | Caroline Dorsa | | | | | 4,441 | | |

| | W. Roy Dunbar | | | | | 1,591 | | |

| | Nicholas C. Fanandakis | | | | | 5,280 | | |

| | Kodwo Ghartey-Tagoe | | | | | 13,242 | | |

| | Lynn J. Good | | | | | 356,430 | | |

| | John T. Herron | | | | | 24,681 | | |

| | Dhiaa M. Jamil | | | | | 42,862 | | |

| | Julia S. Janson | | | | | 38,311 | | |

| | Idalene F. Kesner | | | | | 1,006 | | |

| | E. Marie McKee | | | | | 69,539 | | |

| | Michael J. Pacilio | | | | | 1,636 | | |

| | Thomas E. Skains | | | | | 25,833 | | |

| | William E. Webster, Jr. | | | | | 11,554 | | |

| | Steven K. Young | | | | | 107,859 | | |

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 37 | |

| | Name or Identity of Beneficial Owner | | | Shares of Common Stock Beneficially Owned | ��� | | Percentage | | ||||||

| | The Vanguard Group(1) 100 Vanguard Blvd. Malvern, PA 19355 | | | | | 66,738,560 | | | | | | 8.68% | | |

| | BlackRock Inc.(2) 40 East 52nd Street New York, NY 10022 | | | | | 53,412,420 | | | | | | 6.90% | | |

| | State Street Corporation(3) State Street Financial Center One Lincoln Street Boston, MA 02111 | | | | | 39,416,653 | | | | | | 5.13% | | |

| Name or Identity of Beneficial Owner | | Shares of Common Stock Beneficially Owned | | Percentage | | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | ||||||

| The Vanguard Group | | | 51,528,433 | | | | 7.36 | % | | ||

| 100 Vanguard Blvd. Malvern, PA 19355 | | | | | | | | ||||

BlackRock Inc. | | | 45,499,220 | | | | 6.5 | % | | ||

| 40 East 52nd Street New York, NY 10022 | | | | | | | | ||||

| | | | | | | ||||||

| | 38 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

The Audit Committee Deloitte’s level of service, industry experience, and the Board believe that the continued retention of Deloitte as Duke Energy's independent registered public accounting firm is in the best interests of the Corporation and our shareholders. Deloitte's years of experience with Duke Energy have allowed them to gain expertise regarding Duke Energy'sEnergy’s operations, accounting policies and practices, and internal controls over financial reporting. It also prevents the significant time commitment that educating a new auditor would entail, which could also result in a distraction in focus for Duke Energy management.

management and enables a more efficient fee structure.

Information on Deloitte’s fees for services rendered in 2021 and 2020 are listed below.

partner, including discussing candidate qualifications and interviewing potential candidates put forth by Deloitte. Deloitte’s lead engagement partner was last approved by the Audit Committee in 2018 to begin in the 2019 audit year.

advance of or at the Annual Meeting.

| | Type of Fees | | | 2021 | | | 2020 | | ||||||

| | Audit Fees(1) | | | | $ | 13,160,000 | | | | | $ | 12,949,000 | | |

| | Audit-Related Fees(2) | | | | | 1,496,000 | | | | | | 1,681,000 | | |

| | Tax Fees(3) | | | | | 20,000 | | | | | | 75,000 | | |

| | All Other Fees(4) | | | | | 30,000 | | | | | | 10,000 | | |

| | Total fees: | | | | $ | 14,706,000 | | | | | $ | 14,715,000 | | |

| Type of Fees | | 2017 | | 2016 | | ||||

|---|---|---|---|---|---|---|---|---|---|

| | | | | | | ||||

Audit Fees(1)(5) | | $ | 13,535,000 | | | $ | 13,616,400 | | |

Audit-Related Fees(2)(5) | | 249,000 | | | 626,000 | | | ||

Tax Fees(3) | | 1,746,000 | | | 384,000 | | | ||

All Other Fees(4) | | 50,000 | | | 225,000 | | | ||

| | | | | | | ||||

TOTAL FEES: | | $ | 15,580,000 | | | $ | 14,851,400 | | |

| | | | | | | ||||

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 39 | |

2021. The information contained in this report of the Audit Committee shall not be deemed to be "soliciting material"“soliciting material” or "filed"“filed” or "incorporated“incorporated by reference"reference” in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that Duke Energy specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

” issued by the Committee of Sponsoring Organizations of the Treadway Commission.

34 DUKE ENERGY – 2018 Proxy Statement

| | 40 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

At the 2011 and 2017 Annual Meetings, our

NEOs.

"

”

NEOs.

DUKE ENERGY – 2018 Proxy Statement 35

| | BUILDING A SMARTER ENERGY FUTURE® | | | DUKE ENERGY 2022 PROXY STATEMENT 41 | |

| | |||||

| Name | |||||

|---|---|---|---|---|---|

| | | Title | | ||

| | Lynn J. Good | | Chair, President and | | |

| | Steven K. Young | | | Executive Vice President and | |

| | Dhiaa M. Jamil | | | Executive Vice President and | |

| | Julia S. Janson | | | Executive Vice President | |

| | Kodwo Ghartey-Tagoe | | | Executive Vice President, Chief Legal Officer and Corporate Secretary | |

| | • Our compensation program is designed to link pay to performance, with the goal of attracting and | |||

| aligning the interests of our management team with those of key stakeholders, including shareholders and customers. • Our compensation program provides significant upside and downside potential depending on actual results, as compared to predetermined goals for success. • When establishing our executive compensation program for 2021, we took into consideration the evolving nature of our business strategy along with a focus on maximizing long-term value and providing safe, reliable, and cost-effective service to our customers. | | | ![[MISSING IMAGE: tm221429d2-pc_saypaypn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d2-pc_saypaypn.jpg) | |

|

|

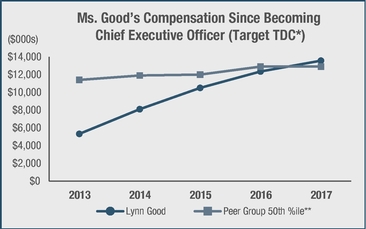

We have a longstandinglong-standing history of engaging with, and responding to the feedback provided by, our shareholders and value the deep relationships we have built. TheThat feedback our shareholders have provided over time has greatly informed our compensation and governance programs, as well as our environmental and social initiatives. We received 82.71% favorable support from our shareholders for our executive compensation program pursuant to the "say on pay" vote at our 2017 annual meeting. In response,Given its success, we continued our shareholder outreach program in 2017, reaching out to shareholders representing approximately 36%2021, meeting with the holders of outstanding shares and engaging with shareholders representing approximately 30%more than one-third of our outstanding shares. Our outreach team included independent members of our Board, as well as management who represented therepresenting, among others, Investor Relations, Government Affairs, Sustainability, Human Resources, and the Legal Departments, as well as E. Marie McKee, the Chair of the Compensation Committee, who participated in a number of the conversations with our largest shareholders.

Department.

36 DUKE ENERGY – 2018 Proxy Statement

| | 42 DUKE ENERGY 2022 PROXY STATEMENT | | | BUILDING A SMARTER ENERGY FUTURE® | |

Taking into account the feedback

executive compensation program. Shareholders also were pleased that environmental, customer satisfaction, and safety metrics continue to be incorporated into our incentive plans.

topics.

![[MISSING IMAGE: tm221429d1-tbl_climatepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-tbl_climatepn.jpg)

![[MISSING IMAGE: tm221429d1-fc_transformpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-036004/tm221429d1-fc_transformpn.jpg)

| BUILDING A | | | DUKE ENERGY 2022 PROXY STATEMENT 43 | |

We have successfully implemented our business transformation strategy to maximize the competitiveness